Global Vehicle Theft Analysis

A deep-dive analysis of vehicle theft worldwide and the access technologies shifting to reduce risk.

1. Credits and Acknowledgements

The “Global Vehicle Theft Analysis” report by Technotrend Market Research examines vehicle theft patterns across 69 countries from 2003 to 2021 and links them to the shift toward digital vehicle access technologies through 2025 forecasts. Data visualization and layout were produced with Datagraphy Studio, with research, data curation and narrative developed by Technotrend Market Research.

Note: Visuals by Roshan De Silva , (Datagraphy Studio); and Research by Giorgio Zanella , (Technotrend Market Research).

2. Contents

The contents are divided into three main parts:

Data presentation and overview

・Introduction

・Data Explanation

・2021 Overview

・Latest Regional & Country Breakdown

・Global Vehicle Theft Trend

Trends and bottom-up analysis

・The Global Shift in Vehicle Theft

・Significant Vehicle Theft by Country

・A Closer Look at the Figures

・Population vs. Vehicle Theft

・Countries with High Theft Counts & Rates

Technology breakdown analysis

・Vehicle Access Technology Trends

・Passenger Car Market Fluctuations

・The Evolution of Vehicle Access

・Which Regions Adopt Digital Key Faster?

・Conclusion

3. Introduction

This report provides a data-driven analysis of global vehicle theft (2003–2021) and the parallel evolution of secure access technologies through 2025. By utilizing UNODC data, we map the shift from mechanical keys to advanced UWB and BLE digital solutions. The analysis offers a multi-layered view of the market, combining raw theft counts with population-based rates to highlight global demand for next-generation security.

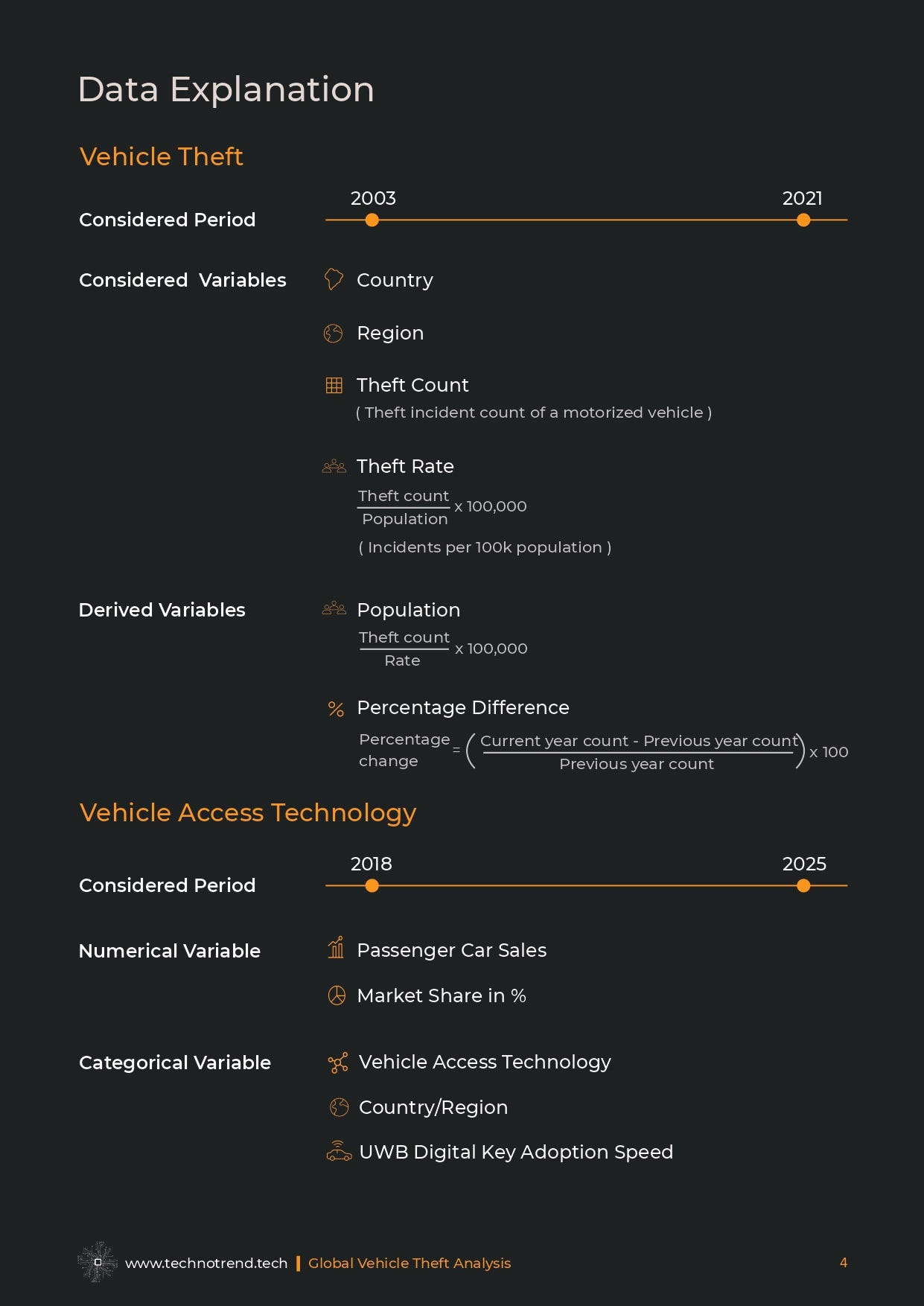

4. Methodology

This page defines the report’s core metrics and explains how key measures are calculated, including theft counts, theft rates per 100,000 population and year-over-year changes. The report uses 2021 as a reference year because it provides the most complete country coverage in the 2003–2021 window.

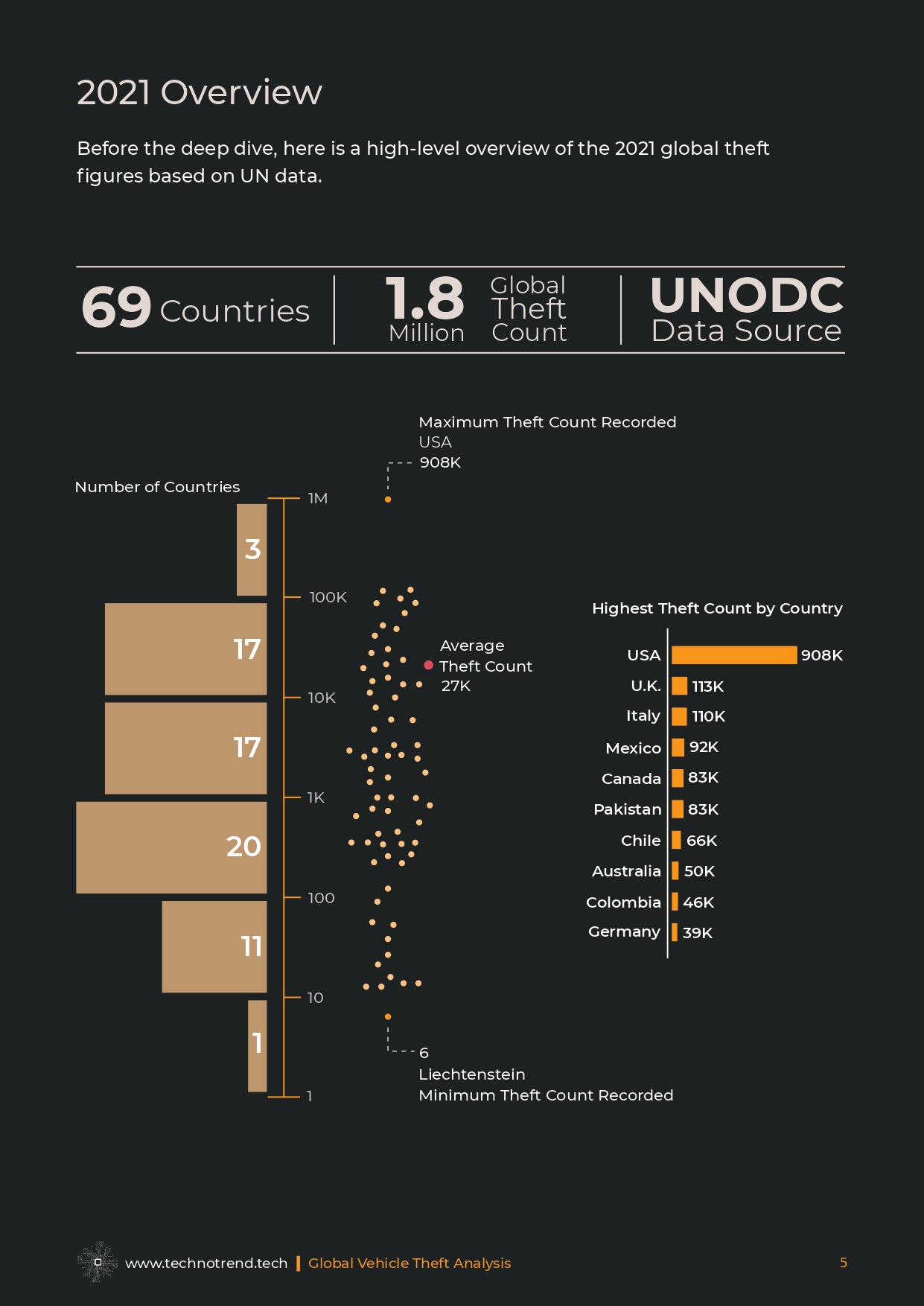

5. 2021 Overview

The 2021 snapshot covers 69 countries and totals about 1.8 million recorded vehicle theft incidents. Theft volume is highly concentrated: the U.S. leads with about 908,000 thefts, while Liechtenstein records six. A second tier includes the U.K. (about 113,000), Italy (about 110,000), Mexico (about 92,000), Canada and Pakistan (about 83,000 each), followed by Chile, Australia, Colombia and Germany.

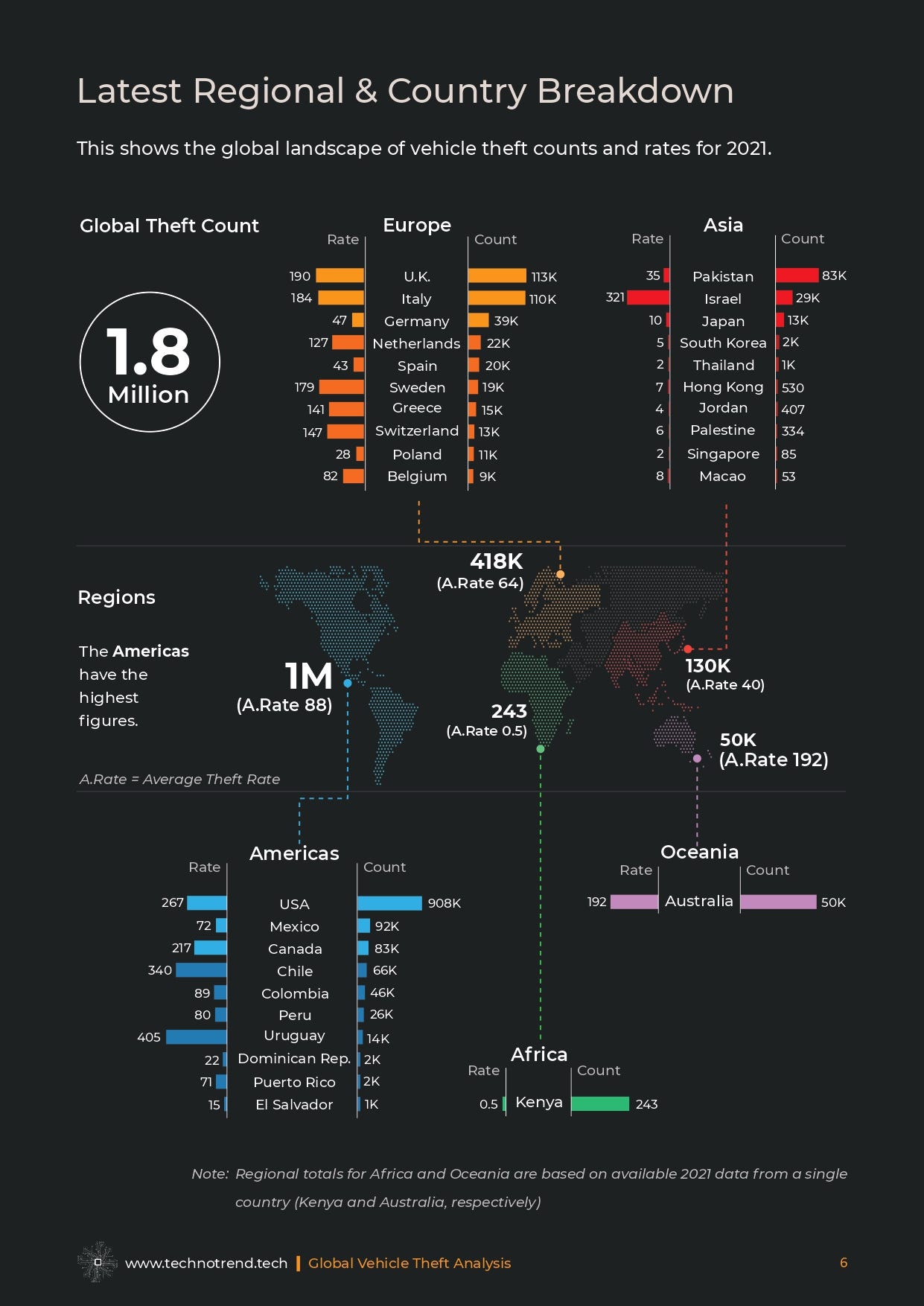

6. Latest Regional & Country Breakdowns

The report’s 2021 regional view shows theft counts concentrated in the Americas, led by the U.S., with Mexico and Canada forming a second tier at scale. Europe posts a smaller total than the Americas but includes several high-intensity markets, including the U.K. (rate 190) and Italy (rate 184). The page also shows why rates can shift priorities: Uruguay posts a very high rate (405) despite a far smaller total count than top-volume markets.

Oceania is represented by Australia in this dataset, with ~50K recorded vehicle thefts in 2021 and a theft rate of 192 per 100,000 population. Australia’s count is material in global terms, placing it among the higher-volume theft countries listed in the report (alongside markets like Chile, Colombia, and Germany). The rate (192) also indicates a relatively high theft intensity, comparable to several European high-theft markets shown on the same page (e.g., the U.K. at 190 and Italy at 184).

Asia is not homogeneous in this snapshot: the headline total (~130K thefts; A.Rate 40) masks very different country patterns. Pakistan is the “scale” case, 83K thefts, but a mid-level rate (35) close to the regional average shown. Israel is the “intensity” case, 29K thefts paired with a very high rate of 321 per 100,000. Japan (13K; rate 10) sits in a lower-theft, lower-rate profile. South Korea (2K; rate 5) and Thailand (1K; rate 2) reinforce that low-rate environments also exist within the region. In Asia, prioritization depends on whether the goal is maximum volume (Pakistan) or maximum urgency (Israel); several other markets show comparatively lower theft intensity.

Africa regional total is built from one country only (Kenya), shown as 243 thefts with a rate of 0.5, and the report explicitly warns that Africa regional totals are constrained by single-country availability in 2021. Because of this limited coverage, the Africa total is not directly comparable with other regions.

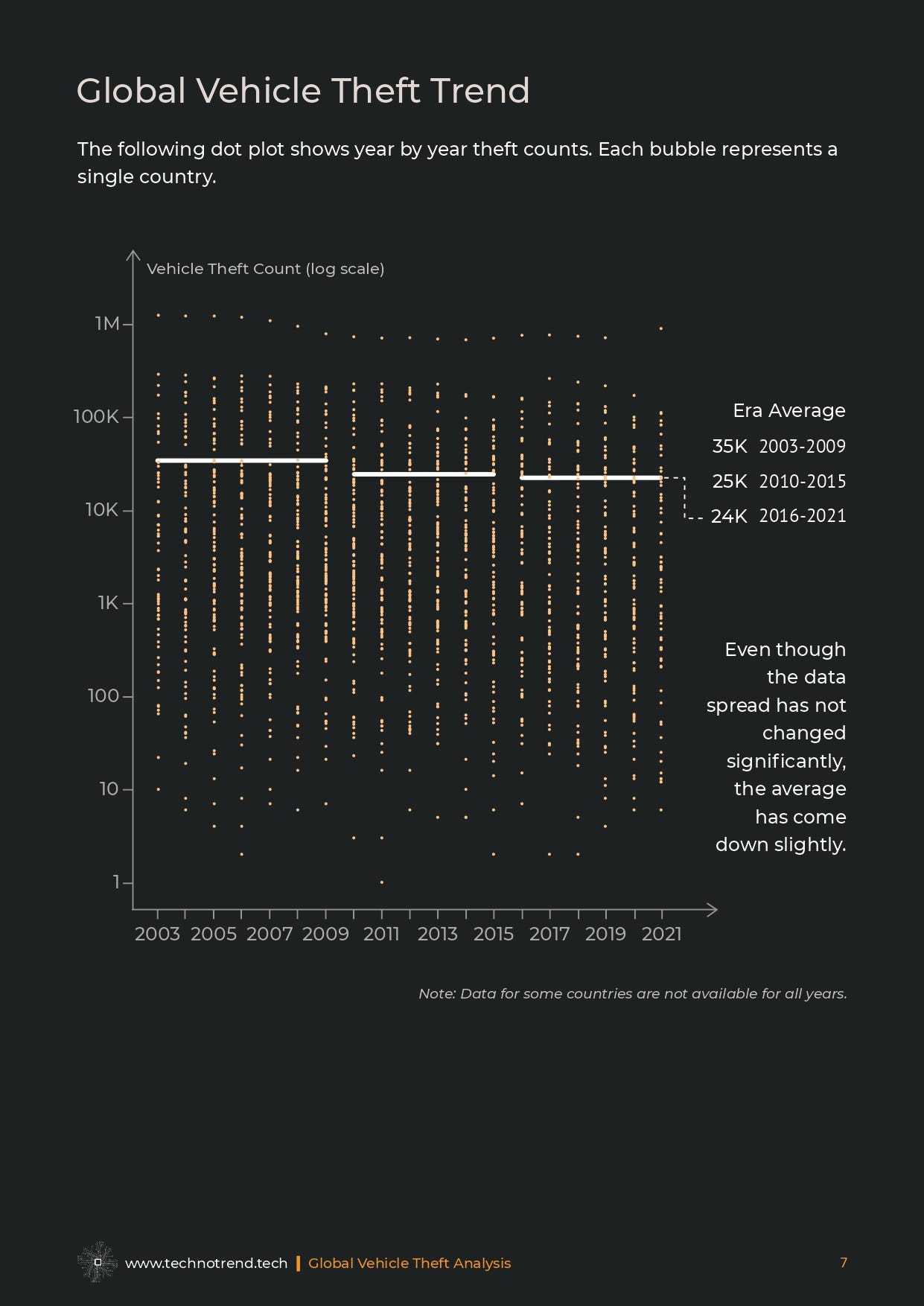

7. Global Vehicle Theft Trend

The era averages decline from about 35K (2003–2009) to about 25K (2010–2015) and about 24K (2016–2021), suggesting a modest downward shift in typical reported theft volumes over time. However, the chart remains widely dispersed, indicating that cross-country differences stay large even as averages edge down. The page also notes that some countries lack data for all years, which can affect trend interpretation.

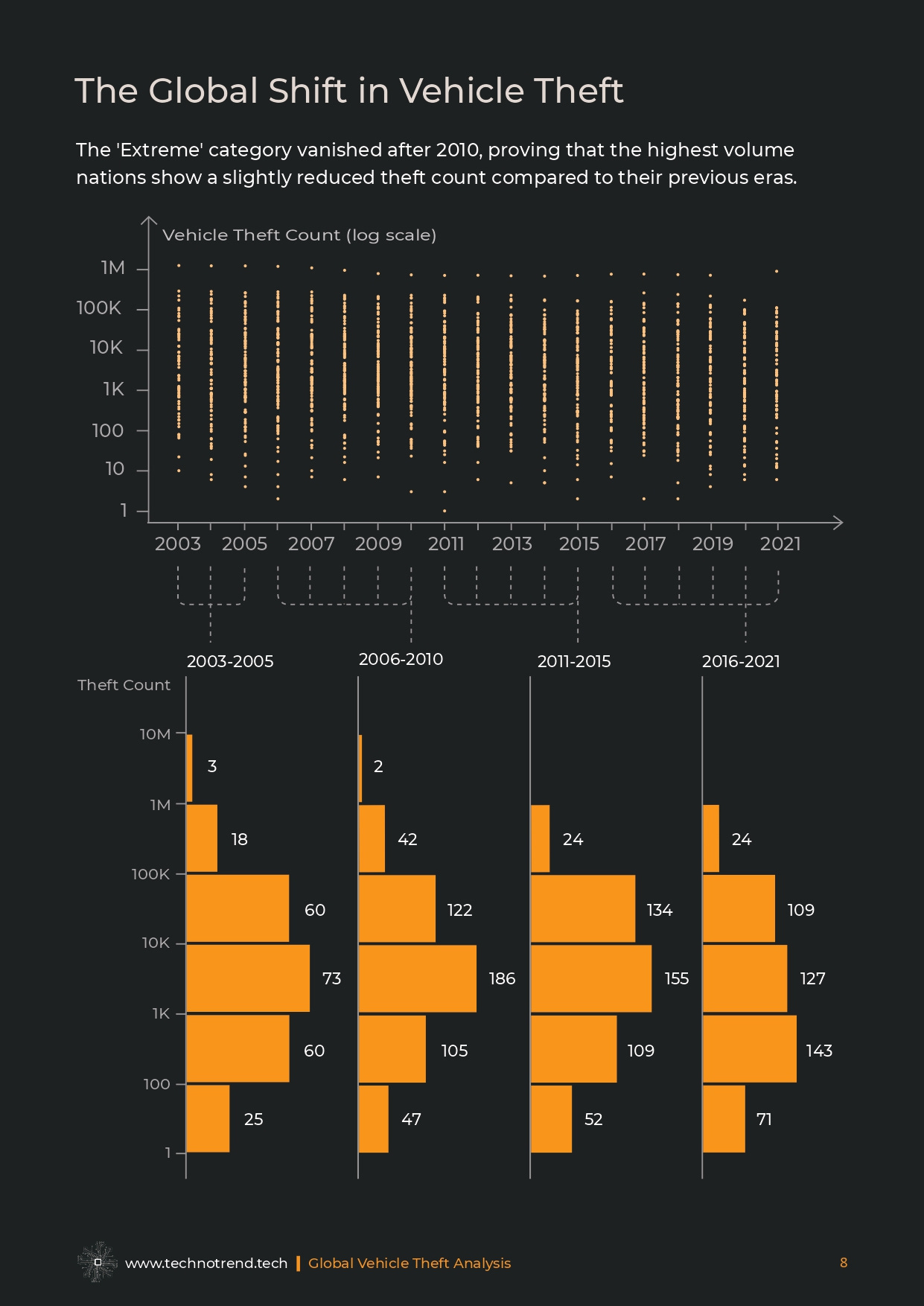

8. The Global Shift in Vehicle Theft

After 2010, the highest Theft vehicle volume category disappeared, suggesting the biggest theft affected countries no longer hit the same peak levels seen in earlier years.

In a nutshell, the global theft problem does not shrink everywhere at once; instead, the most important shift is that the worst outliers become less severe, while many countries remain widely separated in theft volume. The takeaway is that progress at the top can pull down headline totals, but it does not eliminate hot spots, so targeting still has to be country-specific, not “region-average” driven.

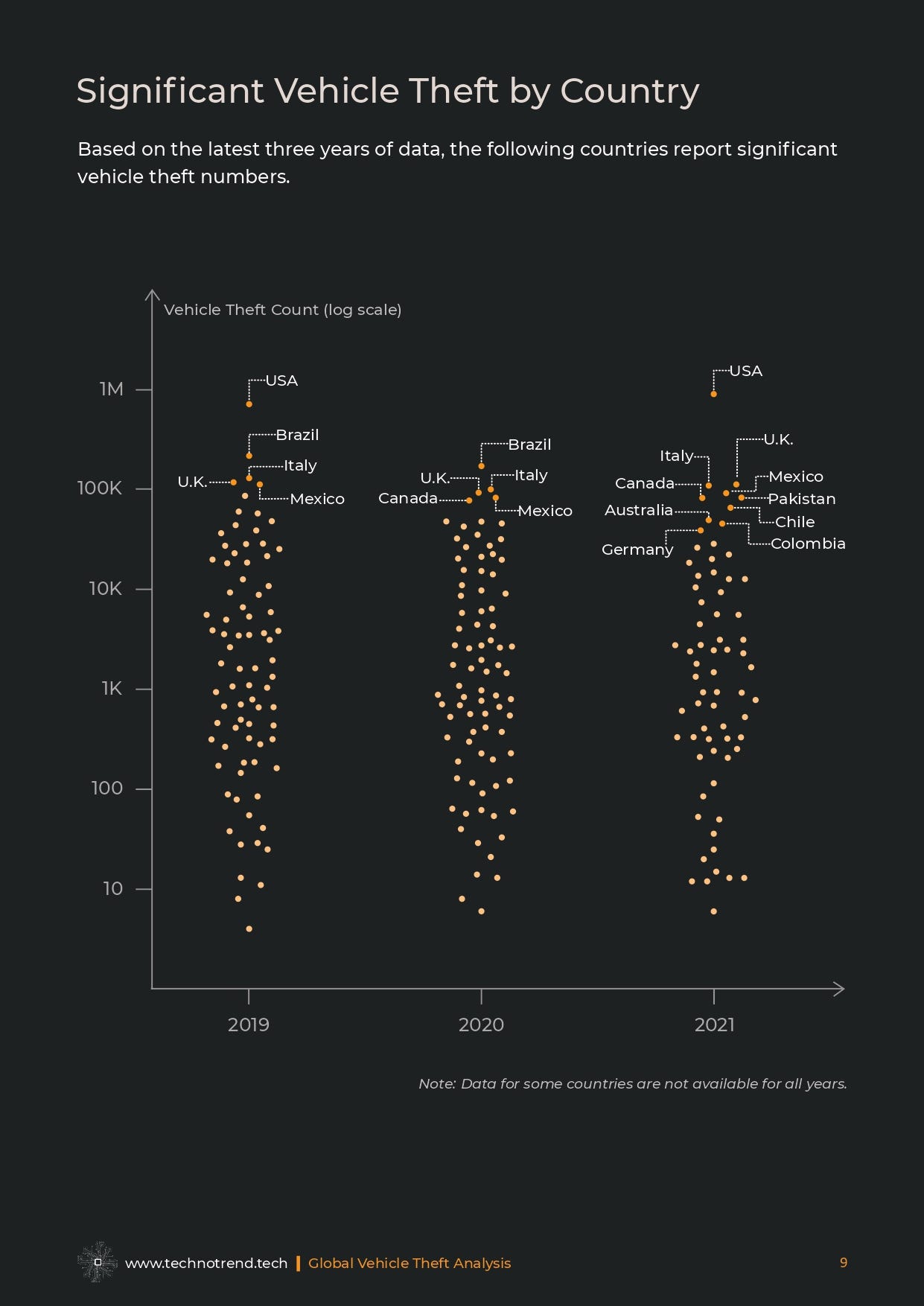

9. Significant Vehicle Theft by Country

The chart puts the spotlight on the most recent three years in the dataset (2019, 2020 and 2021) and asks a simple question: which countries keep showing up with significant vehicle theft volumes. It is less about a single-year headline and more about repeat appearances, which is often a better signal of persistent risk than a one-off spike.

Across those three years, the same core markets recur, including the United States, Brazil, Italy, Mexico, the United Kingdom and Canada, with additional countries such as Pakistan, Chile, Australia, Colombia and Germany also appearing as notable high-theft markets in this recent-window view. The implied takeaway is continuity: the “problem set” is relatively stable, suggesting structural drivers (market size, vehicle fleet size, organized theft patterns) rather than random volatility.

Notably, data for some countries are not available for all years, so absence from the 2019–2021 view does not necessarily mean low theft, it may also reflect reporting gaps.

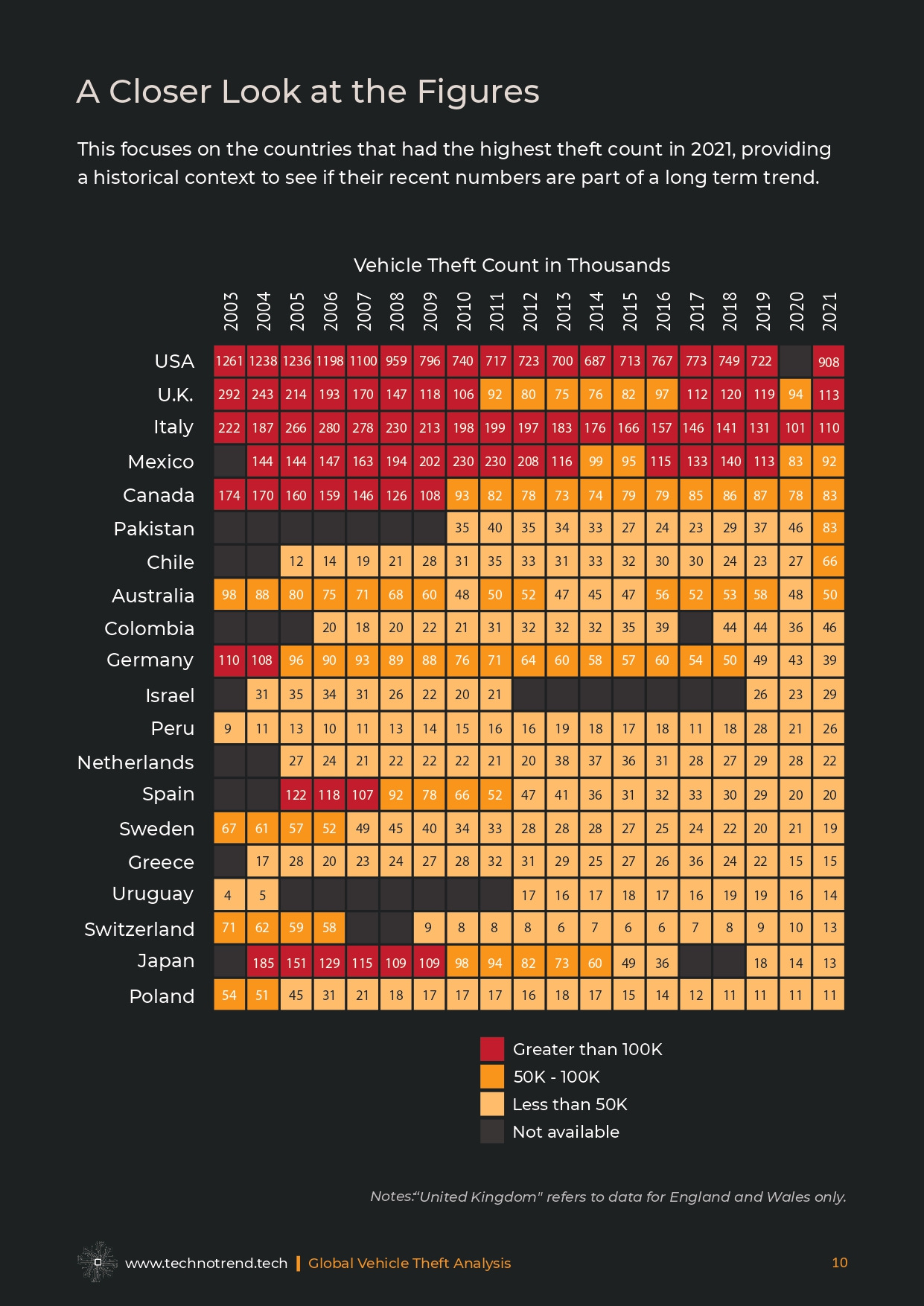

10. A Closer Look at the Figures

This page tracks annual theft counts from 2003 to 2021 for the countries that ranked highest by theft volume in 2021, showing whether today’s hotspots are long-running or newly elevated. It groups annual totals into bands (less than 50K, 50K–100K, greater than 100K) and marks missing observations as “not available,” keeping the focus on trajectory rather than a single-year ranking. A note clarifies that “United Kingdom” refers to England and Wales only.

The long-run view suggests that several “top 2021” countries are not experiencing isolated spikes; instead, they sit in recurring high-count ranges across many years. The U.S. remains the largest market by volume, and its 2021 count (about 908K) is below earlier peaks above 1.2 million, consistent with the report’s broader message that peak extremes have moderated over time. However, the series rises from 2019–2020 levels to 2021, indicating a renewed increase in recent years. The “not available” gaps are a reminder that trend comparisons can reflect reporting continuity as much as underlying theft dynamics.