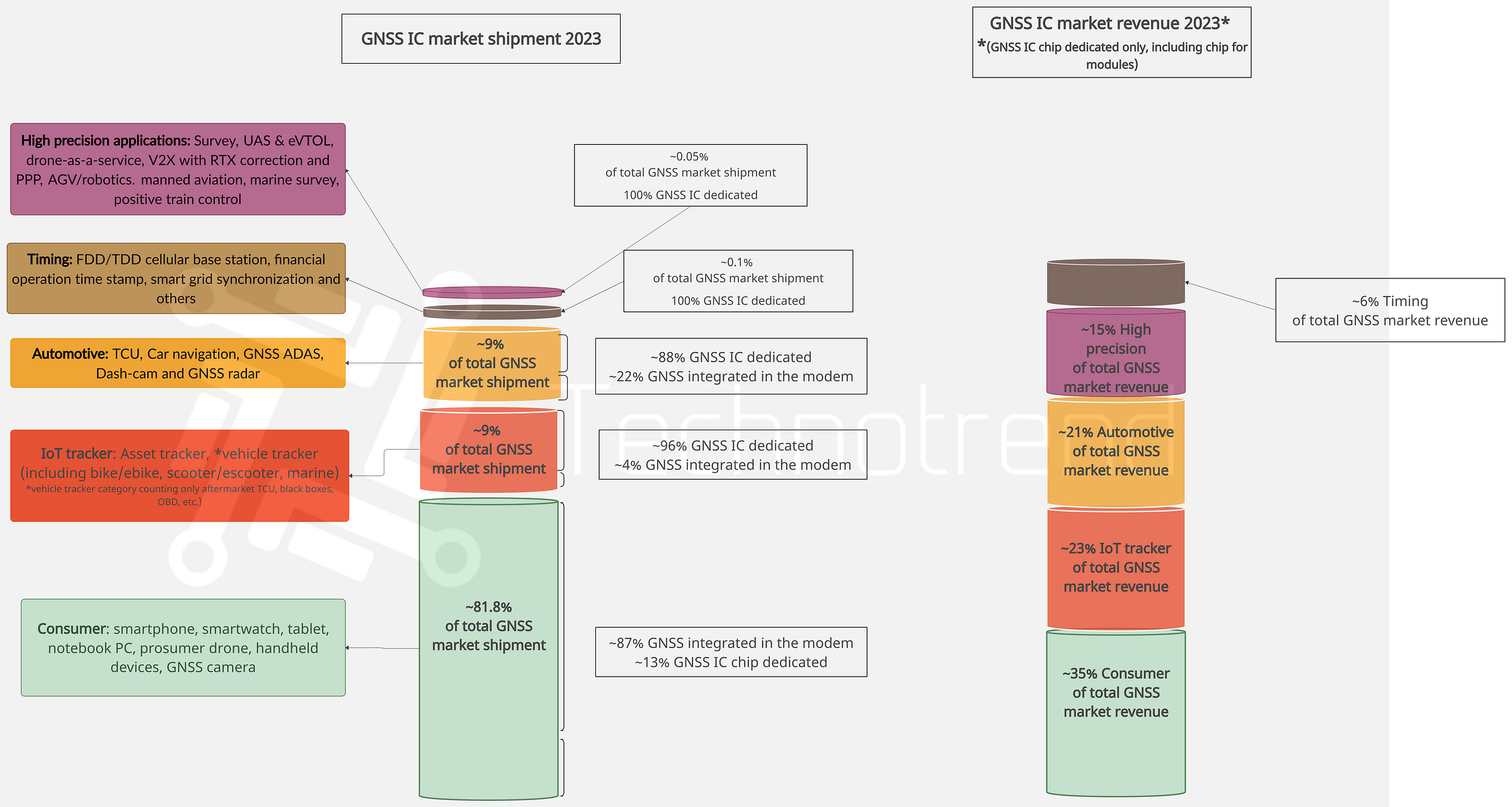

Above the representation of GNSS total shipment and related total revenue by main verticals

GNSS general market introduction

The GNSS device market is witnessing dynamic trends across various sectors, reshaping the landscape of global positioning technologies. In consumer electronics, smartphones and smartwatches are embracing GNSS multi-frequency systems…